New Toyo International Holdings is a leading regional provider of specialty packaging materials with over 30 years of experience. The Group has two core divisions – Specialty Papers Division focusing on production of laminated foil paper, and coated paper and metalised paper, while the Printed Carton and Labels division offers mainly gravure and lithography or offset printing of packaging materials for cigarettes and fast-moving products.

The company has a strong manufacturing base with multiple facilities located strategically across the region, in Singapore, Malaysia, Vietnam, Australia, China and Thailand, to ensure effective support to its customers in Asia Pacific and the Middle East. The Group specialises in high quality packaging products for international tobacco companies as well as government-owned tobacco monopolies. It also serves locally-based companies in the consumer-related industries.

Fundamental Analysis:

(i) Earnings:

In terms of earnings, we can see that the period-on-period growth rates for gross and net profits have been pretty choppy, with no consistency over the years. However, in terms of margins, the company has been pretty consistent, with gross profit margins approximately 16% – 17% and net profit margins averaging around 5% – 6%. Also, EPS has been relatively stable over the years.

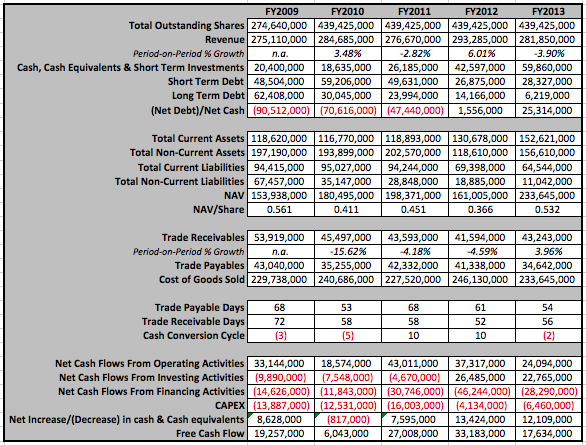

(ii) Balance Sheet & Cash Flows:

We can observe that the company has been able to turn around from a net debt to a net cash company, with SGD 25.3million net cash at the end of FY2013. Furthermore, the company has been able to reduce their long term debts from SGD 62million to SGD 6million. Going forward, if the company is able to continue this performance, it would definitely signify long term competitive advantage because the company is so profitable that even expansions or acquisitions are self financed.

One can observe that the growth in revenues had outpaced the growth in receivables in all years except FY2013. Also, the growth is not really aligned, where for certain years, growth in revenue is positive, yet growth in trade receivables is negative. For this, I still have not found any adequate reasoning. Also, in terms of cash conversion cycle, we can observe that is is negative for a number of years which can be dangerous. However, given the company’s clients being renowned, reputable and of good credit standing (e.g. BAT), it mitigates the risk of defaults and the negative figures are not a cause for worry.

In terms of cash flow, it is strong where the company is consistently producing positive free cash flows every year. Furthermore, cash from operating activities net investing and financing activities, is still positive, hence the company has consistently been able to add cash back to its reserves. This is evident from the fact that their cash and cash equivalents has been growing steadily each year to an all time high in FY2013 of SGD 59.9million. However, we have to take note that increase in free cash flow is partly due to the reducing of CAPEX spending, and in the long run this may be worrying as it signifies that the company is not reinvesting in its capital goods.

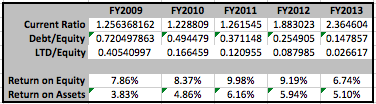

(iii) Financial Ratios:

Looking at the ratios, the company’s ROE and ROA has not been very consistent. However, in terms of indebtedness, the company has been steadily increasing their current ratio, signifying that the ratio of current assets to liabilities is increasing. Furthermore, in terms of total debt and long term debt to equity, it is under 1 and decreasing every year. This is another indicator of the company being able to manage their debt well. Going forward, with the tapering of QE and increases in interest rate, it is encouraging to see the debt levels of the company decreasing.

In my next post, I would be covering the qualitative aspect of the company.

Hi.This is what i found on the internet. C.C.C.= avg days of receivables + avg days of inventory – average days of payables. Is there any different with your cash conversion cycle? Yours is trade payable days -trade receivable days

Hi KH,

Yes you are right, I will have it amended soon. Thanks for pointing out! That said, my conclusion would still remain the same. By adding inventory days, it would actually bring the CCC into positive, making even better.

The EBITDA margin of Amvig is so much higher than New Toyo.

Amvig ~ 23.3%

New Toyo ~ 13.7%

Amcor had made the right move to buy Amvig instead of New Toyo.

http://www.amvig.com/eng/ir/highlight.htm

Sorry, I do not really understand what’s your point. However, I shall structure my reply based on the assumption that you mean that we should have considered AMVIG instead of New Toyo.

Undeniably, AMVIG has a higher EBITDA margin than New Toyo. However, just considering EBITDA margins is a very myopic view. While high EBITDA margins shows the strength of the company in terms of its economic moat, however, we have to consider that both companies have different businesses. While both companies are in the packaging industry, however, they have different businesses. Such as AMVIG is purely doing tobacco packaging whilst New Toyo has 3 business segments, specialty paper, printing of labels and trading. Different businesses have different margins, I won’t claim to be an expert in understanding these businesses, but I would just like to point out that essentially both companies are still different. Hence, when comparing EBITDA margins, it can only merely act as a gauge but not a hard and fast rule when comparing.

Secondly, both companies were in different markets. To us, investing in another country would expose us to FOREX risks. More importantly, with our core portfolio based in SG, just entering into a stock in a new market would greatly increase our diversification risk as it would mean our HK portfolio would only contain 1 stock. While I myself do enter the HK and UK market from time to time, it is purely based on smart speculation reasons. Hence, AMVIG was never something we were considering to investing for long term.

Perhaps AMVIG is also another undervalued stock, however, I have not done any in-depth research on this counter. Also our buy style is not one that we are considering on a global scale and only selecting the most undervalued stock within each sector. Perhaps, you have done a more in-depth research on AMVIG and you won’t mind sharing it with me?

Are you worried that regulation such as plain packaging will have a adverse impact on New Toyo’s profit, as already seen in its recent Q1 results?

The following article seemed to point out the real truth that the consumption of tobacco and cigarettes is falling and has fallen sharply since the plain packaging rules were implemented in December 2012.

http://thekouk.com/blog/the-australian-s-claim-on-tobacco-go-up-in-smoke.html#.U5Z3Cc9ZrJy

This is the first time I’m seeing this, good job on your research. Honestly, Q1’s profit fall was unexpected. Some say its due to the relocation of its factories while your point is that it is due to regulations.

I doubt the regulations were the main reason for Q1’s fall for two reasons. If what is stated is true, New Toyo’s profit should have fallen consistently since December 2012. Consumption was at the lowest in Q1 2014, but that does not mean there should be a sudden, steep drop in revenue, because the decrease can and was gradual. Also, revenue from Australia constitutes about 14% of New Toyo’s revenue. Unless margin’s are extraordinarily high in Australia, the regulations would have a negative but not too significant impact of New Toyo’s performance.

Nevertheless, it is always about personal taste and interpretations, you are always free to disagree and walk away from the stock if you are not comfortable.

In the event of a take over, how much is the investor willing to pay to buy over Mr Yen’s 53% stake in New Toyo? If the valuation is based on book NAV, the upside will be very limited indeed…

That depends ultimately on one’s thesis for buying New Toyo. For us, New Toyo was never a takeover/privatisation play so this is not a concern for us. Assuming someone did bought it solely on the prospects of Mr Yen’s stake being bought over, then the upside will be limited. However, I doubt valuations will be based on book NAV for a manufacturing company.

Would like to point out that the business is still producing positive FCF with sustainable debt. Hence, other than the fact that the owner is getting older, he does not face any pressure to sell his company. If you were the owner and the counterparty does offer to buyout your stake at book NAV, would you be willing to sell it in this scenario? Usually companies that are sold at a price below its fair value are when owners are faced with mounting debts and pressured to raise cash (you may look at the case of STX OSV).

You might wish to read up Tien Wah’s 2013 Annual report since New Toyo has a 53% controlling stake in Tien Wah to better understand the challenges faced by Tien Wah.

***

On reflection, 2013 was a year in which the main industry which we are operating in continued to have significant dynamic changes, which had

an indirect impact on our overall business.

Amongst one of the more significant event which we had highlighted earlier was the change in pack design regulations which impacted the speed

required to respond to the regulatory requirements of design changes of our customers’ products. It is difficult to state whether or not these

regulatory changes would have had an adverse and sustainable impact on volumes of tobacco packaging requirements in the markets where

these regulations apply.

The second significant event was the drastic increase in duties in certain markets which impacted all industry players in market volumes and had

the reverse impact of increasing more illicit products.

The third significant event was the new challenge our major customer set us, which was to reduce quality issues by 50% within a year, in order that our

key customer could supply to more quality demanding overseas markets. This demanded a new set of process and resources of the Group.

These combined events did contribute to the decline in the demand for packaging materials thus affecting our revenue, which declined by 6.8%

or RM27.7 million as compared to 2012. The Company is still strongly profitable at RM24.5 million but this net profit represented a reduction from

the previous year of RM27.2 million, a decline of 9.9% due to reasons explained above.

Our balance sheet remains favourable with the Group’s net assets (excluding non-controlling interests) increasing by 5.6% to RM229.1 million

from RM217.0 million. The debt levels have reduced from RM92.2 million to RM72.9 million, an improvement to the interest effectiveness of the

borrowing. The business also continued to cash generate positively in the year under review amounted to RM58.3 million (2012: RM77.8 million).

Shaping our future for 2014 and beyond

The year 2013 was a challenging year for our Group. Looking forward

and considering the ongoing development in our equipment footprint,

we will continue to position ourselves to service the changing demand

of the tobacco segment. The tobacco printed packaging segment

will further increase in all aspects of competition, so as such 2014

and beyond will require ongoing focus on customers’ complaints

reduction, operational/cost efficiencies and effectiveness, and business

development across all customer segments. Our Group remains in a

good position to seize new business opportunities for both the tobacco

segment and the general print segment for certain locations.

Our customers’ intensity in retaining and growing market-share resulted

in further investment into our technical capabilities during 2013. Most

of this capability will be in place during 2014 and this will put our Group

in a unique position in relation to product offer for this region. Our efforts

in this area have, resulted in us being awarded additional contracts

from new customers. Our integrated Enterprise Resources Planning

and Production (“ERP”) software system has now been implemented

across three of our sites, and we expect this system to continue to

yield ongoing benefit for ourselves and our customers.

I honestly don’t see what you are driving at. The only thing I can guess is that “It is difficult to state whether or not these

regulatory changes would have had an adverse and sustainable impact on volumes of tobacco packaging requirements in the markets where

these regulations apply.” and like I said, this is open to interpretations which I have already provided. You are free to disagree, but in this case (as with your many of your previous comments) you seem to be more interested in imposing your views on the counter rather than facilitating any constructive learning points by simply pasting text without offering your own opinion. You must have a lot at stake to call yourself New Toyo Investigator, you probably have no interest in learning and I suggest you frequent other sites instead.

The net cash arose largely from the divestment of SAH (about $60mil) and did not come about as a result of current business.

In fact, the divestment of SAH had led to a drop in EPS from 4.5 cents to about 3.5 cents, and also the reduction in dividend payment.

IMHO. tks.

The net cash position has been increasing even before the divestment of SAH (which was only around $29m and $10m of it was given out as dividends). Also, FCF does not necessarily imply a net cash position. That being said, we should be relooking into New Toyo given what we have just learnt about consolidation. It seems to me that you are expecting a major divestment without a drop in EPS.

883 mil of SAH shares x 1/3 x $0.19 = $56 mil

New Toyo had received $56mil of cash in 2 batches from the divestment of SAH.

Pls check your facts.

Yup you are right, forgot about it.

Indeed, the sale of the SAH shares was for approximately $60mn, if I remember correctly on valuebuddies, it was $58mn, correct me if I’m wrong. That said, this blog we created is a platform for learning and sharing. Hence, I hope you could change your tone, afterall we all make mistakes from time to time.

Never meant to impose my views whatsoever. Just trying to bring more information to the table so that everyone can see and judge for themselves whether New Toyo is really that good an investment after all.

***

In its latest 1st quarter results announcement, Tien Wah mentioned the following:-

Based on the results of the current quarter under review, the directors are of the opinion that the group will have a weaker performance for the financial year. Our prospects in the various industries we are servicing throughout the region have been affected by the various challenges to their business. Plans are in place to seek new markets and segment opportunities and to reduce cost to mitigate the impact.

***********

Well, to a layman, this is a very negative prognosis going forward…

Thanks for your views!

From the news, my partner and I too understand that going forward New Toyo would be facing tough times. That said, we would be reviewing our analysis once again to see if our initial thesis has changed.

New Toyo too has expressed similar comments in its Q1 2014 results. The reduction in revenue SHOULD NOT be due to the shifting of operations from Australia to Vietnam (i.e. downtime for printing) because this ought to have been catered for in the production schedule. The reduction in revenue is due to a drop in printing demand arising from the various challenges (e.g. excise tax resulting in drop in printing volume, plain packaging, etc.)

*****

A commentary at the date of the announcement of the significant trend and competitive conditions of the

industry in which the group operates and any known factors or events that may affect the group in the next

reporting period and the next 12 months.

The industry we operate in continues to be challenging. The Group will continue efforts to leverage our presence in the lower cost production countries and explore opportunities for growth.

Can someone here explain what economic moat does New Toyo or Tien Wah has? In AGM and their annual reports, they just kept saying challenging and competitive environments. Do they really have an economic moat to speak of?

Excise tax is increasing in almost all the regions they are operating in and this has led to a sharp drop in printing volume as evident in the last 3 quarters of results, and this is set to continue…

Also, the exclusive supply contract with BAT is set to expire pretty soon (i.e. by Dec 2015). There is no assurance that they can renew the supply contract with BAT, especially since their financials have been deteriorating in the last 3 quarters, rending it much harder for them to reduce their selling price to BAT to secure the renewal of the exclusive supply.

If the exclusive contract is lost, the EPS will drop by at least 50%, and their cost structure will become unsustainable due to the loss of economies of scale…

Hi Curious Party,

I will attempt to answer both your questions here. When we first bought New Toyo, we did not identify any specific economic moat New Toyo has other than the fact that they have been in this industry long enough and have secured a major client like BAT. To us the main thesis was buying a company with a stable business, consistent margins over the previous years at a really cheap price. When I say cheap here was because of the indicators we used. However, recently after looking into our calculations we did some revisions and realised that it was not as cheap as we thought (we would be doing a post on that). That said, I understand that New Toyo is undergoing some difficult times, however, I feel no company does not experience any headwinds and given their long history, we would have to trust the management that they would be able to lead the company well during these times.

You brought up a good point on the exclusive supply contract that we did not take note of. Thanks!

That said, we have decided to reduce our stake in New Toyo, given the revisions in our calculations changing the multiples that New Toyo is currently trading at.

While there are much negativities on New Toyo for now, there are many things on the bright side too 🙂

Would there be possible Amcor buying of Yen family’s stake in New Toyo to gain control of Tien Wah?

The emergence of Tien Wah as a major printing concern is interesting.

Before 2007, Tien Wah competed with New Toyo and Amcor for printing jobs.

Tien Wah is an established printer listed on Bursa Malaysia but it had only one factory (in Malaysia). New Toyo had two low-cost factories in Vietnam but they lacked track records.

New Toyo’s acquisition of Tien Wah in 2007 and putting Tien Wah in charge of the two factories in Vietnam transformed Tien Wah into a formidable player.

In 2008, Tien Wah ousted Amcor in a tender bid, and bought from the British American Tobacco (BAT) its printing firm in Australia and became the exclusive printer serving four BAT markets for the next seven years.

BAT has also recently required Tien Wah to lower the rate of printing defects to the point of near perfection. Tien Wah is responding well to this requirement, according to its annual report. It would seem that BAT’s stringent requirements have provided Tien Wah the opportunity to demonstrate its capability for higher performance.

There are concerns that the 7-year business agreement with BAT may not be renewed on expiry in Dec 2015. However, it is believed that if Tien Wah maintains its cost advantage and continues to respond to BAT’s new, stringent packaging requirements, there are reasons to be optimistic.

New Toyo is the ultimate holding company of Tien Wah. The printing business, undertaken by 53%-owned Tien Wah, is significant, contributing the bulk of New Toyo’s profit.

Hence, for Amcor to acquire Tien Wah, it has to buy out Yen family’s stake at New Toyo.

New Toyo’s EBITDA is about $40mil. Based on a very conservative EBITDA multiple of only 5 times, New Toyo’s valuation should be approximately 45 cents. If EBITDA multiple is 6 times, then New Toyo will be worth 55 cents.

Is EBITDA multiple of 5 to 6 times considered too conservative if Amcor were to acquire one of the leading tobacco printers in the Asia Pacific region (outside China)? [The above does not take into account the massive cash reserve of some $60mil at New Toyo.]

But currently, New Toyo is only trading at 29.5 cents at SGX. This represents at least 50% to 80% upside potential.

The recent interesting development is that now both the father and son are now no longer in the board of New Toyo. The son has recently relinquished his duty as the chairman of New Toyo.

This brings forth the question of whether the Yen Family is selling off their stake in New Toyo?

The related news on New Toyo can be found at the links below:-

http://www.nextinsight.net/index.php/story-archive-mainmenu-60/924-2014/8301-new-toyo-

http://www.nextinsight.net/index.php/story-archive-mainmenu-60/924-2014/8396-new-toyo-what-impact-on-its-oversized-under-used-aussie-factory

http://www.nextinsight.net/index.php/story-archive-mainmenu-60/919-2013/7063-new-toyo-

Haha true..read those news before too. However, while there is that probability, that happening is more like a bonus to me. Given how Tien Wah is a subsidiary of New Toyo, earnings, assets and all are consolidated. Hence, we felt to derive a more fair value of New Toyo would actually to remove the 44% stake (if I remember the division of stake correctly) of Tien Wah from these earnings and assets (something like the case of Sinarmas Land my partner wrote about). That said, we removed the portion of Tien Wah, with the revised figures we realised that New Toyo was still undervalued but not as undervalued anymore. Given how New Toyo’s uncertain prospects and other stocks that gives us a larger margin of safety, it was the reason for our sell. However, I would still agree that New Toyo at current market price is still undervalued.

New Toyo’s share of Tien Wah equity should be 53%. May I check how did u get the 44% as stated above?

tks.

Oh sorry my bad, I remembered wrong, but the excel sheets were definitely right. However, in essence, that was what we did to get a fair value of New Toyo so to speak.

Amcor acquired some unknown company at 7 TIMES EBITDA.

For New Toyo, Amcor would probably have to pay a high premium to acquire.

****

Amcor announces today, that it has entered into an agreement to acquire Bella Prima Packaging, an Indonesian flexible packaging business for A$27 million. The purchase price represents 7 times CY2013 EBITDA.

7 May, 2014: Bella Prima has two plants in Jakarta specialising in the high growth shrink sleeve, label and lidding business. Sales in CY2013 were approximately A$30 million.

Amcor currently has one flexibles packaging plant in Indonesia. This acquisition is complementary to the existing operations as it broadens Amcor’s participation strategy with its multinational and local customers as well as adding to the local talent pool.

Amcor’s Managing Director and CEO, Ken MacKenzie said: “Indonesia is an attractive market for flexible packaging given its rising per capita income and changing retail formats. The Bella Prima acquisition gives Amcor the opportunity to broaden its product portfolio in attractive end market segments and deepen our relationships with key customers. Given the expected synergy benefits, it is anticipated returns will exceed 20% by year three.”

just curious how many lots did you all invest in New Toyo? If it is just a few hundred lots, probably no harm keep them for the long term dividend and more special dividend along the way…:)

Sorry, we are not that comfortable revealing the amount we invest in each share. I understand your point that one can hold the stock just for the dividends and perhaps a special dividend. However, our investment philosophy is that as long as we are uncertain about a stock, moreover there are other better stocks out there offering us a better mos, we would not hold it for that probability.

Well, there is another school of thought. the rapid deterioration of New Toyo’s profit margin might force the Yen family to dispose of it to a bigger printer group who can reap synergies from consolidation of printing volumes from BAT and PMI.

With a cash hoard of about $60mil or 45% of the current market valuation, one wonder what the company is going to do next?

There could be some possible acquisition of a smaller printer company along the way plus some special dividend…

With the transfer of 50% of the operations from Australia to Vietnam, the net income could probably be boosted by some $2mil – $3mil, offset the recent drop in printing volume.

Plus Tien Wah has explained that it would be going into “higher-value printing” so that it will be able to serve new markets for the BAT. This is definitely a big plus for New Toyo as well.

Plus the economic moat is that there will be a huge switching cost for BAT. In fact, one of the directors sitting in Tien Wah’s Board was from BAT previously. He was the regional head for BAT.

If one carefully examined the original development of Tien Wah and New Toyo, one could easily surmise that BAT wanted to develop Tien Wah and New Toyo as a counterweight to Amcor 🙂

I can see similarities between your post and New Toyo Investigator. I would just like to say that I have been following valuebuddies for quite sometime to know about your ‘reputation’. I do not wish to such things happening on my platform, otherwise I shall not allow posts from you from being approved.