New Toyo International Holdings is a leading regional provider of specialty packaging materials with over 30 years of experience. The Group has two core divisions – Specialty Papers Division focusing on production of laminated foil paper, and coated paper and metalised paper, while the Printed Carton and Labels division offers mainly gravure and lithography or offset printing of packaging materials for cigarettes and fast-moving products.

The company has a strong manufacturing base with multiple facilities located strategically across the region, in Singapore, Malaysia, Vietnam, Australia, China and Thailand, to ensure effective support to its customers in Asia Pacific and the Middle East. The Group specialises in high quality packaging products for international tobacco companies as well as government-owned tobacco monopolies. It also serves locally-based companies in the consumer-related industries.

Fundamental Analysis:

(i) Earnings:

In terms of earnings, we can see that the period-on-period growth rates for gross and net profits have been pretty choppy, with no consistency over the years. However, in terms of margins, the company has been pretty consistent, with gross profit margins approximately 16% – 17% and net profit margins averaging around 5% – 6%. Also, EPS has been relatively stable over the years.

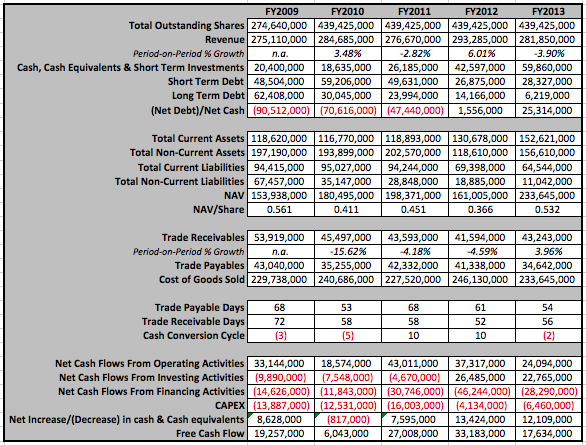

(ii) Balance Sheet & Cash Flows:

We can observe that the company has been able to turn around from a net debt to a net cash company, with SGD 25.3million net cash at the end of FY2013. Furthermore, the company has been able to reduce their long term debts from SGD 62million to SGD 6million. Going forward, if the company is able to continue this performance, it would definitely signify long term competitive advantage because the company is so profitable that even expansions or acquisitions are self financed.

One can observe that the growth in revenues had outpaced the growth in receivables in all years except FY2013. Also, the growth is not really aligned, where for certain years, growth in revenue is positive, yet growth in trade receivables is negative. For this, I still have not found any adequate reasoning. Also, in terms of cash conversion cycle, we can observe that is is negative for a number of years which can be dangerous. However, given the company’s clients being renowned, reputable and of good credit standing (e.g. BAT), it mitigates the risk of defaults and the negative figures are not a cause for worry.

In terms of cash flow, it is strong where the company is consistently producing positive free cash flows every year. Furthermore, cash from operating activities net investing and financing activities, is still positive, hence the company has consistently been able to add cash back to its reserves. This is evident from the fact that their cash and cash equivalents has been growing steadily each year to an all time high in FY2013 of SGD 59.9million. However, we have to take note that increase in free cash flow is partly due to the reducing of CAPEX spending, and in the long run this may be worrying as it signifies that the company is not reinvesting in its capital goods.

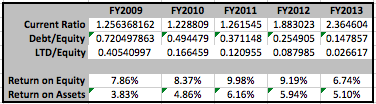

(iii) Financial Ratios:

Looking at the ratios, the company’s ROE and ROA has not been very consistent. However, in terms of indebtedness, the company has been steadily increasing their current ratio, signifying that the ratio of current assets to liabilities is increasing. Furthermore, in terms of total debt and long term debt to equity, it is under 1 and decreasing every year. This is another indicator of the company being able to manage their debt well. Going forward, with the tapering of QE and increases in interest rate, it is encouraging to see the debt levels of the company decreasing.

In my next post, I would be covering the qualitative aspect of the company.