We have briefly covered King Wan (KW) previously with a 3Q update. At that time, KTIS has yet to be listed on the Thai Exchange. Fast forward to the present, with the completion of KTIS’s listing and the release of KW FY14 Annual Report, we take this opportunity to revisit our investment in the company. As our thesis was based mainly on asset value, the bulk of our analysis will be as such.

KTIS Holdings

Upon listing, KW received approximately SGD47.6m worth of shares in KTIS at a listing price of 10 THB each. Taking into account the recent fall in price (9.55THB), KW’s holdings are now worth SGD45.5m, of which SGD21.6m has been recognised in books. Therefore, we have revaluation gains of SGD23.9m.

Vessel Holdings

KW also owns a ‘Supramax’ Bulk carrier held through its 30% owned associate. Gold Hyacinth Development Pte Ltd. This was originally purchased for USD21m, or approximately SGD26.25m based on an exchange rate of 1.25, during a period when the Baltic Dry Index was floundering near a post-crisis low level of 698. Based on DMG’s report in April, the vessel then commanded a market value of USD28m or SGD35m. Correspondingly, KW’s stake will be worth SGD10.5m, a gain of SGD2.6m. However, do note that the Baltic Dry Index in April was almost twice of its current level.

Dormitory Venture

KW recently ventured into the worker dormitory business via a 19% stake in a consortium. The land (in Tuas) has a lease term of 20 years and is to be developed to a facility with 9200 beds. It is anyone’s guess how much profits this will bring, but based on my research, the average rate for 1 bed will conservatively be around SGD250/month. Assuming an occupation rate of 80%, I expect the facility to generate about SGD4.2m in annual revenue for KW. If we use Centurion’s Holdings 3-year low net profit margin of 15% as a reference, we get estimated profits of SGD0.6m. Assuming a dummy discount rate of 10% (I have no confidence in my WACC calculation), terminal growth of 0%, we value the dormitory holdings at SGD5.5m

Pseudo-Sum-of-Parts Value

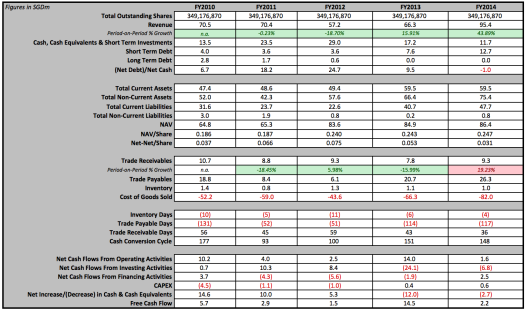

Adding all gains, totalling to SGD32m, to the current reported NAV of SGD86.4m, we arrive at a RNAV value of SGD118.4m. Based on the current number of outstanding shares, we therefore have a fair value of about SGD0.34, which is fairly close to its current share price.

Challenging M&E Industry

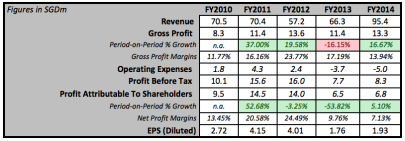

Due to public displeasure about the amount of foreign workers, the Singapore government has been steadily tweaking its policies to reduce the amount of foreign workers employed by companies. As a mechanical engineering company, KW relies heavily on foreigners for its labour. You can see that we are starting to observe the effects of the policies through the increased labour costs, with gross profit margins falling consistently from 23.8% in 2012 to 14.8% in 2014. While revenue has been increasing steadily, this hasn’t added much to the bottom line. If we discount KTIS’ contribution of SGD7.2m in 2012, net profit has from its core operations have actually been decreasing. In the past, the price afforded a margin of safety sufficient to offset this, but given KW’s share price increase, this is no longer something we can be certain of. To put things simply, even if KW were to maintain its very impressive top line growth, profits would still be decreasing. To top it off (pun intended), with the slowdown in property markets, I think it would be a challenge for KW to continue its top revenue growth.

Property Developments

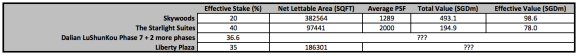

Things are not all bad for KW however; our fair value of SGD0.34 has been based on the assumption that we value its operations and its property developments at book value. Through its associates, KW has stakes in a number of properties in Singapore, Taiwan and China which are accounted at book value of SGD2.1m. The properties and their estimated values are as below:

The estimates are based on average transacted prices from Squarefoot Research multiplied by the net leasable area from the official condo websites, note that these values do not include the cost of development and percentage sold. Unfortunately, we do not have enough information to value the remaining properties in China and Thailand, but I think at book value of SGD2.1m, we are fairly safe from much downside, in light of the fact property sales in Singapore and China have slowed down considerably.

Conclusion

Upon KTIS’s listing and its current share price of SGD0.345, we think that our original thesis (value of KTIS) for KW has already run its due course given our targeted fair value of SGD0.34. Moving forward, we have identified downside risks to its operations, negated by upside potential from its property developments. Potential for future revaluation gains are definitely present, but since we are unable to place an estimate, we refrain from including them in our calculation of fair value to be on the safe side. One thing is clear that the margin of safety is much lower now, with future returns to be more uncertain than before given the volatile nature of KTIS shares and KW’s vessel holdings. Furthermore, given how KW is currently trading at P/E 17.9x, normalised EV/EBITDA 13.1x and normalised FCF yield of 3.23%, we have decided to exit our position in King Wan Corporation. We leave it to each individual to weigh the risks and potential gains based on your risk appetite..

Disclosure: The authors have no vested interest in 554.SI

Please check your figures again.

You got the numbers for FY2013 and 2014 mixed up in the 1st table.

Eg: Gross profit for 2014 is 13.3mil, for 2013 its 11.4mil.

Not the other way around

GPM for 2013 and 2014 are 17.15% & 13.99% respectively

Hi Keith,

Thanks for pointing it out. I have amended the tables.

Price has dropped to around $0.31. If it dip below $0.30, is it a good entry price ?

To be honest, it varies with individuals. For me, I need to at least see a minimum of 33% margin of safety before investing. Hence, it would really depend on how far it dips below $0.30. Given that King Wan was bought based on asset play, a fair value would be $0.34. Therefore, for me a low $0.20s would be a good entry price. However, King Wan is undoubtedly a good and stable company.

Can I ask why is the analysis based solely on the valuation of each of the parts that make up King wan? (Sum of the parts)

Why just analyse the assets, and not pay attention to other valuation metrics such as the quality and reliability of earnings, PER, Cashflows and of course good old qualitative factors like the strength of the management?

The main reason would be because when we first bought this company in December 2012, we bought it based on asset play. However, I did consider valuation metrics (like you mentioned) and wrote it in the conclusion where the P/E is 17.9x, normalised EV/EBITDA 13.1x and normalised FCF yield is 3.23%. Based on such valuation metrics, it too indicated to me that King Wan no longer appears in my category of ‘undervalued stocks’ As much as quality and reliability of earnings, strength of management are all important factors when assessing a company, however, it is difficult to put a value to it. Hence, to me such factors are important when looking at an undervalued company, but when it comes to a company that is fairly valued or overvalued I would no longer look at such factors.

Thanks for the reply.

i’d like to point out though, that the PER seems high (17.9 according to your calculations) now, but in the next quarter, KW will recognise the $24 million gain from the listing of KTIS. That works out to 6.87 cents per share alone, which is about the same as the combined value of the earnings per share for the past 3 years! And that’s from the gain alone.

my point is that the earnings are very volatile:

2011 2012 2013 2014

4.15 4.01 2.02 1.93

and 2015 is likely to be above 8 cents, so a better way analyse P/E based on the average earnings over the last 5 yrs.

Another point is that the business model of KW is such that there is little or minimal cost to getting recurring earnings.There are certain fixed costs to support their equipment etc, but once that is accounted for, the equipment is sufficient to provide recurring earnings with minimal capital needed for subsequent projects.

I do agree that KW is no longer as undervalued as before, but I think it’s still undervalued.

A fair value would be closer to $0.40 for now.

No worries, glad to hear views from other readers as well! Well you are right, a more accurate method would be to take a 5 year normalised earnings to calculate the PER and it would come up to around 11.8x, which in my opinion is still relatively high. I would not say that King Wan is overvalued at current levels, but rather fairly valued. Given our investment mandate of investing in undervalued stocks, we felt that our investment has run its due course and exited at SGD0.35.

Ironically, the FY15Q1 results are just released, 1 day after our discussion.

The 5 yr earnings average, if it includes FY2015, won’t give you a PER of anything around 11.8x. It is difficult to predict FY2015 earnings, but in FY15Q1 alone, with the recognition of KTIS sale profits as well as dividend received recently from KTIS, KW has a 7.42 cents earnings, compared to 0.74. That’s a one off increase of 1000%

Just earlier, I said FY2015 earnings is likely to be above 8 cents, but even that is now an underestimation since 1Q alone the earnings is 7.42.

If we conservatively predict FY15 earnings as 9 cents, the average earnings for the past 5 years is 4.22 cents. That gives us a PER of around 7.6x currently.

NAV is also increased to 31.83 cents.

I haven’t analysed in detail, but just taking a quick look, I noticed the KTIS stake is carried in the books as $31,669,194. That works out to approximately 9.3 THB based on current exchange rates. KTIS share price right now is 10.6 THB.

So right now, at the current price, KW is trading at 1x book value, PER of around 7.6x, dividend yield of 6.25%. Along with other indicators like the FCF, visibility of order books, and likely recognition of a greater bulk of earnings at the mid – later stages of projects, these are the reasons why I think the fair value is higher.

BTW, I am vested at $0.26/0.265, 1000 lots.

Thanks for the posts though, I do enjoy all the detailed analysis and always look forward to the new posts. I’ll love to comment if I chance upon something that I have analysed and am familiar with.

Hi Keith,

Allow me to chip in in this. You are perfectly right in saying that PER is much lower; around 7.6x as you have correctly pointed out. There are 2 reasons why I used a SOTP valuation over earnings-centric valuation like PER.

1) The PER itself does not give us an intrinsic value. A 7.6x PER itself does not indicate what is a fair value. The next step usually would be to peg it to an industry average. But this is something I am not comfortable with as there is always the possibility of comparing less-rotten apples with more-rotten apple. So what is the PER that you are willing to pay? This is also why we favour FCF yield over PER. With the FCF yield, you can determine logically what you think is a fair FCF yield for such a company if you were to own 100% of it, without having to rely exclusively on comparisons. its 5-year average FCF yield of 3.23% suggests little upside from its operations.

2) Using a 5-year normalized PER would not be the most accurate as it included historical contributions from its not discontinued Thai sugar operations. Without any adjustments, such a PER would not be indicative of the earnings moving forward. We feel that to utilise PER, or any other earnings-centric valuation, it should be applied to only core earnings from its core, ongoing operations/business. King Wan does not pass this litmus test; as you have pointed out it is a one-time gain due to the recognition of KTIS.

Regarding the other factors which you have pointed out – recurring earnings, visibility of orderbooks, bulk recognition of earnings – these are things which we admittedly still don’t know how to verify (maybe you wouldn’t mind sharing?). However, orderbook value of SGD164m up till 2017 seems to be on a low side. Of course, we don’t know how much of this is to be recognised in FY2015, but we would need SGD78m of it to be recognised just to maintain the same revenue as FY2014. Then, you also have the issue of rising labour costs so even with the same revenue, you will be getting lower profits. With a challenging industry outlook, it would be swimming against the current to post a revenue gain – and revenue has declined 31% YoY in Q1. Dividend yield becomes a secondary consideration when core performance is uncertain.

Asset-wise, it is arguable that King Wan may be undervalued. The issue here is that their potential is highly uncertain; KTIS could be worth 20 THB per share for all we know (or it could be worht 5 THB), and the same applies to the vessel. We are not comfortable in buying/holding a M&E company just for the possibility of gains in its sugar and maritime exposure, especially when we do not have the capability to evaluate them. For example, we valued KTIS at its then-current price of 9.55 THB and the price as risen about 10% since then. I have absolutely no clue about the fair value of KTIS and I think a large part of the ‘King Wan undervalued’ story would depend on that.

As always, knowledge triumphs and it won’t be surprising if someone with the knowledge knows that they are indeed undervalued currently.

Thanks Keith for your interesting and thought-provoking comments. It would do some people good to learn how to start a discussion as you have done. Looking forward to any further thoughts.

Thank you for the reply.

It certainly helped me to understand more deeply about KW and created more thought processes in my analysis of value.