I’ve been having the hardest of times piecing together an analysis on Sinarmas Land. Unfortunately, I am unable to overcome my various apprehensions and doubts about the company to produce a complete analysis. This is solely due to my (lack of) depth of knowledge; it certainly does not reflect anything negative about the company but through the course of my attempted analysis, I did learn a few vital lessons which I would like to share.

I’ll start by what analysis I have of the company and draw out the lessons from there.

Sinarmas Land

Description:

Sinarmas Land Limited is engaged in the property business through its operations in Indonesia, China, Malaysia and Singapore. It combines two big developers: Bumi Serpong Damai Tbk (BDSE) and Duta Pertiwi Tbk (DUTI) that are both listed on the Indonesian stock exchange.

Fundamental Analysis:

BDSE and DUTI comprise a large part of the Sinarmas entity. We focus our attention first on determining a fair value for these two subsidiaries.

As of 16/5/2014 and assuming an exchange rate of 0.0011, BSDE has a market capitalisation of SGD3232.8m and is 49.87% owned by Sinarmas. Similarly, DUTI has a market capitalisation of 402.2SGDm and is 44.16% owned by Sinarmas. Using an equity weighted approach, they constitute a market value of SGD1789.8m in total. This actually exceeds Sinarmas’ current market capitalisation of SGD1719m. Considering that Sinarmas has substantial assets besides the two, it seems that the counter is severely undervalued, at face value. It is certainly tempting to conclude as such, but if we do believe that price will converge to its true value in the long term, then the risk in such a conclusion would be that the true value of BDSE and DUTI is actually less than it currently is. We therefore have to ascertain the fair value of BDSE and DUTI, i.e. are they currently overpriced?

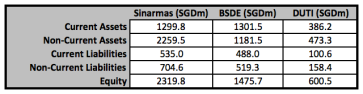

A quick snapshot of the Balance Sheet of the 3 companies:

BDSE – Market cap of SGD3232.8m vs equity of SGD1475.7m.

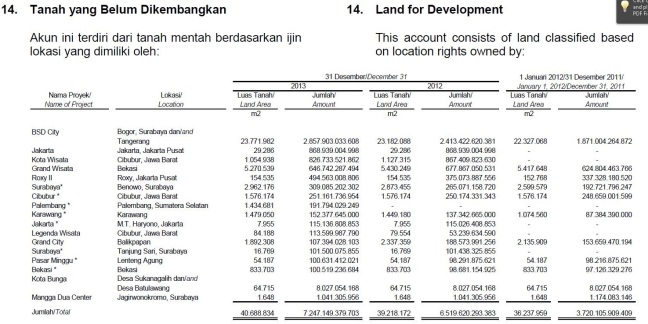

Paying 2.19x BV is very steep for a developer; most developers in the Singapore market trade below book value. From a value perspective, the only reason to do such a thing would be if the RNAV is significantly higher. Personally, I feel that a price of 0.8-1.0 times of RNAV would be a comfortable range for a fair value. In this case, this would require the RNAV to be at least double of BDSE’s current BV. Typically, the bulk of asset revaluation lies in a company’s non-current asset which, for BDSE, comprises largely of its Land for Development account.

Unfortunately, imperfect information is often a bane of retail investors and particularly so when it comes to dealing with foreign companies. The only information I could get out my secondary research in terms of market pricing was the news about BDSE selling up to 95 hectares of land for RP 2 trillion to joint ventures. This translates to RP 2,105,263 per sqm of land in BSD City versus RP 120,221 per sqm (amount divided by land area) in the book. That’s 20 times more.

This is where I ran into my first roadblock. If you choose to believe such reasoning, this counter would be severely undervalued. However, looking at the historical values of the various lands in the account, I notice that the amounts have been revised even when the land area has remained the same. This points to the likelihood that the book value is actually revised yearly which contradicts the purpose of our revaluation exercise and this is only the tip of the iceberg. My next roadblock is due to the consolidation of subsidiaries and it provided me with the most important revelation I have had in a long time.

Pitfalls of Consolidation

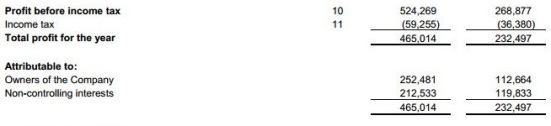

Based on common accounting practices, a parent company is required to consolidate its reports with its subsidiaries. This is why there is often a ‘Profits due to non-controlling interests’ line in the income statement. While most would only focus at the bottom number, this is something you should adjust for (or I would anyway).

As can be seen in Sinarmas’ case, there is a substantial difference between both numbers which will drastically affect your valuations.

In terms of balance sheet at the parent level, the balance sheet of the subsidiaries is always fully consolidated, regardless of the percentage of ownership by the parent. The rationale is that as long as a parent has a majority stake, it will have full control over the subsidiary’s assets. We investors should know better that this does not equate to full ownership over all of the subsidiary’s assets, therefore, adjustments would have to be made to reflect the percentage of ownership.

Sharp-eyed readers will notice that the sum of BDSE’s and DUTI’s accounts exceeds that of Sinarmas which might seem to refute the point I just made. For example, total current asset for BDSE and DUTI is around SGD1700m vs Sinarmas SGD1300m. This is because when consolidation is done by the parent, adjustments are made to remove intra-group transactions; you cannot earn money by selling to yourself. Therefore, the equity value of a parent should always be less than the sum of its subsidiary’s book value, assuming they are not fully owned and that there are not other assets owned by the parent company. The same concept applies when calculating fair value.

To deal with this, common practise is to apply a holding company’s discount of 20-30%. A better method would be to subtract the value of the company’s books from the group’s (for the various accounts), and then compare this value to the sum of the subsidaries’ books to approximate the percentage discount, but that’s only if they are listed. Caution will also have to be exercised when valuing the ‘Associated Companies’ account of the parent because there might not be a conspicuous distinction between associates of subsidiaries and associates of the parent company. If you are not careful, you might end up valuing the same entity twice.

It gets more complicated when it comes to the cash flow statement because cash flow statements are always consolidated at a group level and is unadjusted for subsidiary contributions. If the subsidiaries were all from similar industries, we might be able to assume that their cost make-up are similar (same percentage of depreciation etc.), then we can adjust the cash flows based on a percentage of ownership basis as well. Nevertheless, it is still a rather stretched assumption because the sizes of the subsidiaries may still differ. It’s even worse when the subsidiaries are in vastly different industries, and unfortunately in this instance I do not have the slightest clue. I admit this is an area I have yet to seriously contemplate but it is definitely something I will explore deeper so till then, all that I have said about cash flow statement might be just gibberish.

The implications are dire and clear; how often have we taken a group-level cash flow value to calculate free cash flow? And when we did that, did we even consider the degree of subsidiary contribution? For parents with fully owned subsidiaries, we would have dodged a bullet. But for companies like Sinarmas which considers 49.87% and 44.16% owned companies as subsidiaries, the difference would be far, far too huge.

With that and after so much deliberation on how to analyse Sinarmas Land, I suddenly recall a very wise man’s analogy about baseball and investing.

“What’s nice about investing is you don’t have to swing at pitches. You can watch pitches come in one inch above or one inch below your navel and you don’t have to swing. No umpire is going to call you out. You can wait for the pitch you want.”

Disclosure: The authors have no vested interest in A26.SI

Nice analysis…

I looked at Sinarmas land very briefly few months back. I thought they have a section on the PnL that account for minority interest?

Hi sillyinvestor,

Yes, they do have a section on the PnL and I think all companies will have that section. However, when it comes to the balance sheet and cash flow statements there’s no such provision and it’s always based on consolidated figures which can be misleading.

Oh ya, just check the the Q1 report, there is non- controlling interest at PnL, minus profits from non-controlling add back depreciation and amortization then u can be a rough oCF at sinarmas level, then check if FCF is strong.

For a developer, their FCF ( without I accounting for non-controlling stake, I missed it!), is rather strong because they have mature malls too.

Main budbear is dividend.

If I misunderstood your doubts, sorry for kaypoing! Maybe can explain again? So that we can learn from each other. Did I get your concern right ?

No worries, I like your attitude! My main point was that even a rough oCF is difficult because when you add back depreciation and amortization, you also have to account for the NCI. Similarly, from oCF to FCF, capex would also have to be adjusted. In Sinarmas’ case, it might be simpler because the subsidiaries which are listed, but for other companies we might not be so little and the picture becomes even more blur.

Admittedly, I did not consider the cash flow of Sinarmas much because my priorirty is usually NAV analysis when it comes to developers, but you’re not wrong there!

Just my 2 cents…since i did not spend much/any time analysing the company (nor as skilled).

As you have pointed out, Sinarmas Land operate under a holdco structure. The simplified corporate structure can be found in their annual report. However, the reason why you cant add across DUTI and BSDE is because Sinarmas Land owns DUTI through BSDE. If you read BSDE’s annual report, you will find that BSDE owns 88.56% of DUTI. Sinarmas Land owns 49.87% of BSDE, which in turns gives 49.87% x 88.56% = 44.16% effective interest.

Hence, consolidation by adding across all the assets should work. The first steps for consolidation (confirm with any accountants) is to add across all ASSETS and LIABILITIES. Only a portion of the equity will be pulled out to be recognised as minority interest. On the other hand, income statement is a bit complicated due to intercompany transactions. However, most property companies also seldom make intercompany transactions, since it probably doesnt make sense [if they are not part of the value chain]?

On the consolidation of cash flows, I am not very familiar with this since I dont vaguely remember doing anything like that in accounting school. However, i believe it should just be a simple add across of all the cash flow statements for all the subsidiaries, with no proportion adjustments for its ownership. Afterall, the cash balance on the balance sheet is just a simple add across the balance sheets, and the cash flow statement eventually has to agree with the ending cash balance on the balance sheet. Thus, to find out the FCFF of the entities ex-BSDE, just minus off BSDE’s FCFF from Sinarmas Land’s FCFF.

In any case, Indonesian corporates are structured to be as complicated as possible, such that the owner can control his entire empire without much effective stake. Hence, it probably doesnt pay much to try to split the financial statements. The complex structure also makes it difficult to analyse and value the company properly, as you have pointed out.

On valuing a properly firm, i thought that it is mostly done by RNAV (as you have pointed out). Besides, given the super holdco structure with minority stakes, it doesnt make much sense to be looking at FCF or OCF since the cashflow/income statement is mostly ‘fake’ if they dont redistribute the cash up to the holdco level. Instead, I thought it probably makes more sense to just use the 1) RNAV method, 2) proportionate P&L from the subsidiaries, or 3) dividends/FCFF upstream from the subsidiaries.

Just to add, one major concern on Sinarmas Land is its relations to the Sinarmas Group, particularly their corporate governance issues and historical default (from Asia Pulp & Paper). I would attribute that to one of the reasons why Golden Agri seems to always trade poorly compared to the other palm oil companies. That being said, i’m not that familiar with the decision making process of these equity players, so i cant say for sure they deserve a bigger discount for their past.

Thanks for your feedback! I admit I did not know about the cross-holdings and it kind of makes me doubt the integrity of the Sinarmas Land management as their annual report is very easily misinterpreted.

I’m not sure if I understand your point correctly about consolidation on the balance sheet, are you saying that it is has already been adjusted for ownership because they are pulled out? If that’s the case then it would tie with the cash flow which you have mentioned to be a simple summation. Otherwise, I think you misunderstood my point. I am aware that consolidation of balance sheet and cash flow is done on a simple summation basis, but what I’m arguing is that from a value perspective, such a method might lead to inflated balance sheets for example. If the entities are listed then it is easy to minus of the FCFF just as you have pointed but if they aren’t then I’m really at a lost on how to adjust for them. Agree on your valuation points completely. I guess sillyinvestor did raise a valid point as well – there might be certain situations where FCF can be useful, but I think your concept applies to the majority. Unfortunately, I’m also not too familiar with the other big equity players in Indonesia but I actually think that you’re more skilled haha. Thanks for your very good points.