Sinwa Limited, with a history dating back to the 1960s, they are Asia Pacific’s leading marine, offshore supply and logistics company servicing the marine and offshore industry in Singapore, China and Australia. With a network spanning 12 major locations and delivering premium service to more than 100 key ports, they operate on a motto of ‘Right On Time, At Any Time’. It is this solid reputation for reliability that 90% of their revenue is repeat business.

Fundamental Analysis:

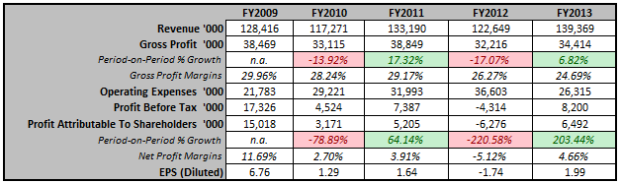

(I) Earnings:

While gross profit margins have remained roughly constant over the years – within a band of 25% to 30%, we can see that the growth in gross profits have fluctuated greatly. Furthermore, looking at their net profit margins (NPM), it has been declining since 2009 and even entering the negative region in 2012. We only see an improvement in the margins from FY2012 to FY2013. In this industry, one thing we have to understand is, chartering is a high margin business while supply is a low margin business. The high NPM in FY2009 is explained by the business split mainly into chartering and supply. The decline is due to the company starting to deviate away from the chartering business and into engineering. As the company continued to reduce their chartering business and increase their engineering business, we observe the company’s profits being affected greatly as engineering was never their expertise. However, in FY2013, we see a recovery due to the CEO changing the direction of the company by divesting all non-core businesses and focusing on their core business which is supply. This also explains the lower margins comparing 2009 and 2013, despite most of the non-core businesses being divested in FY2013. It is my believe that 4.66% is not the normalized NPM level yet as we see margins in the latest quarterly results to be approximately 10%, of which approximately 2% is attributable to the sale of the tugboat. Also, after talking to their IR, it is difficult to ascertain the industry’s average for NPM as most of their competitors are small and non-listed players. Moreover, Sinwa being a market leader in Singapore is well-armed with robust infrastructure. As such, they are able to operate with higher efficiency (cost savings) as well as ability to order in larger bulk (lower cost price from suppliers). This allows Sinwa to enjoy higher margins. Lastly, we see that EPS has been increasing, where EPS in the latest quarter alone was 1.12. However, we have to bear in mind that it was partly due to the sale of the tugboat. Going forward, we should also note another one off improvement in margins and EPS after the settlement of the dispute over the Nordic Vessel.

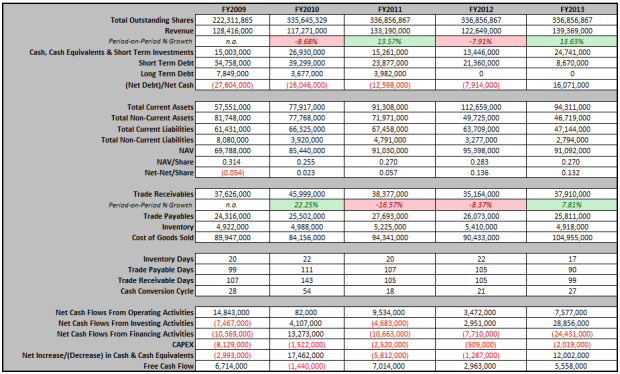

(II) Balance Sheet & Cash Flows:

What started out as a net debt company, the new CEO has been able to turn this around and in FY2013 the company is a net cash company. Furthermore, they have been reducing their debt levels ever year, where in FY2012; they have effectively paid off their long term debt. While NAV has decreased, this is not a cause of for concern as it is mainly due to management divesting away its non-core business; hence, a decrease in NAV is not surprising. Furthermore, the company’s cash conversion cycle has always been positive, which is another positive sign. That said, Sinwa’s customers are mainly reputable customers such as Sodexo and BP; further decreasing concerns of probabilities of clients not paying on time, or the need to write off bad debts. Furthermore, given how their business operates on repeat customers, on the perspective of their customers, it would be ideal for them to build up a good working relationship with Sinwa too.

Looking at the company’s cash flows, we can see cash decreasing for several years, attributable to the non-core business burning cash. However, with the change in company’s direction, we see cash levels increasing in FY2013 and a positive Free Cash Flow (FCF). Furthermore, looking at the latest quarterly results, cash levels have increased by approximately another SGD8million. However, the increase in cash is also attributable to one off gains from the disposals of assets from the non-core business.

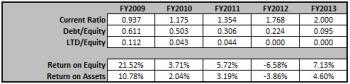

(III) Financial Ratios:

Looking at the ratios, there is nothing more that I would like to add. Increasing Current Ratios, decreasing Debt/Equity and LTD/Equity reaching 0 are all positive signs. Furthermore, looking at the Return on Equity and Assets, they have been improving, but once again we have to understand the difference between FY2009 and FY2013 is due to the change in business as explained before.

Qualitative Analysis:

(I) Understanding the Industry:

Within the ship chandling industry, there are 5 major players that dominate approximately 65% of the Asia Pacific market, with Sinwa being the largest. The other 4 significant players are namely Fuji Trading, Wrist, HMS Group and EMS Seven Seas. Furthermore, within this industry in Singapore, we can observe consolidation of market share by the bigger players as vessel owners start to prefer working with the bigger companies.

Furthermore, with regards to the nature of this industry, it requires companies like Sinwa to be ready at any point in time. To quote Bruce Rann, “As a case in point, just last week, one of Sinwa’s largest clients placed an order worth SGD185,000 and wanted it by 10am the following day. Sinwa filled the order on time”. Evidently, we can see the competitive nature of this industry, where new and smaller entrants would definitely find it difficult to compete with these larger players.

(II) Key Elements in their Supply Business:

Their clients want guaranteed, timely, and quality supplies and services, which Sinwa is able to provide. This is evident from 90% of their revenue being made up of repeat businesses. Furthermore, their No. 1 client – Sodexo, is a global company and is the largest catering company in the world. As Sodexo continues to grow within the Asia Pacific region, it is definitely advantageous for Sinwa.

(III) Going Forward:

In growing their bottom-line, they are planning to enter into the Thailand market, where the oil and gas industry is growing. Expectations of the demand for marine, offshore supply and logistical services would outstrip the local supply, hence, making it ideal for Sinwa to grab onto this opportunity. I had my concerns with regards to this, given Thailand’s political situation, and Sinwa’s IR has reflected that the company is still reviewing this and reviewing if their step into Thailand is still feasible. Also, assuming that the company does enter into the Thailand market, we would not expect a huge increase in terms of CAPEX spending, as the company will be resorting to renting until they have entrenched themselves with a steady customer base.

Also, the company has plans on expanding their warehouse so that they are able to directly import chilled food such as Australian meat. By doing so, they are able to cut out the middleman, reduce operating cost and buy in bulk, which would further decrease their operating costs. The company expects to spend SGD10.5 – 11million on building the bigger warehouse, which in my opinion, the company is able to do so comfortably without taking excessive loans.

From this, I feel that management has learnt from their past mistakes and taking more prudent steps going forward in expanding their business.

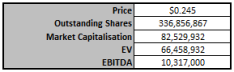

Valuation:

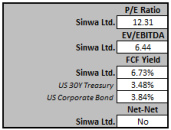

Looking at Sinwa in terms of P/E, it is definitely not cheap especially based on empirical research on the Singapore market. In terms of EV/EBITDA of 6.44 it can be considered relatively fairly valued. While in terms of FCF yield, it is somewhat undervalued given that it has a FCF yield of 6.7% which is significantly above the benchmarks, even after applying a 33% discount allowing for errors. Lastly, the company is definitely not a net-net based on Graham’s Net Working Capital formula.

Conclusion:

At the current price of SGD0.245, Sinwa is not an undervalued company in my opinion. It can be seen that most of the indicators would indicate that Sinwa is probably nearing a fairly valued company at this point in time. Assessing Sinwa qualitatively, it is evident that management has been taking decisive steps in changing the company’s direction, which has proven successful for the time being, bringing the company back into the ‘green’. Going forward, it would really be dependent on how successfully the management ‘steers this ship’, especially if they were to enter the Thai market. Overall, my view is that other than the fact that management has been able to turn the company around it still lacks a fair margin of safety for investors.

Disclosure: The authors has no vested interest in 5CN.SI

Agreed not a value buy anymore.

Haha yup! Like you said, not much meat left already. People would are buying now would probably be based on their view on how management is able to grow the company.

finally someone coming up with some serious research.thanks for that.

Thanks! Hoping to further improve my analysis with advice from people like you 🙂