Have been pretty busy recently to actually post part 2 of New Toyo. However, will post the full analysis done on ADT Corporation first.

ADT Corporation is a provider of electronic security, interactive home and business automation and monitoring services for residences and small businesses in the US and Canada. The company provides home, business and home health solutions and services. It was a spinoff from its parent company Tyco in September 2012, and is the largest home/small business in USA and Canada.

Fundamental Analysis:

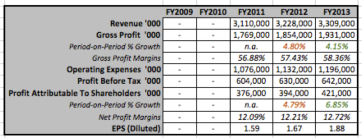

(I) Earnings:

While growth of gross profits and net profits have been fluctuating year on year, it is important to note the consistency in gross profit margins and net profit margins at approximately 57% and 12% respectively. Furthermore, EPS has been increasing each year.

(II) Balance Sheet & Cash Flows:

Being a relatively young company, it is still a net debt company. However, given it ability to generate positive FCF of approximately USD 500 million, I do not foresee much issues with its debt. Moreover, most of its debt are long term debt, hence, in the short run, the company only has to settle the debt of USD 3 million. Moreover, if one calculates the LTD/Equity, which can be seen later, it is less than 1. Therefore, with the issue of indebtedness, it is not much of an issue. Looking at the cash conversion cycle, it is positive and the huge difference between trade receivable days and trade payable days is something worth taking note of.

(III) Financial Ratios:

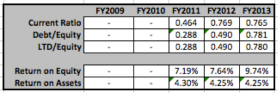

In terms of ratios, we can observe that current ratio has increased quite significantly from FY2011 to FY2012 and stagnated somewhat from FY2012 to FY2013. While Debt/Equity and LTD/Equity has increased over the years, as said previously, I do not foresee much problems going forward given how the company has been able to generate positive FCF and that these figures are still below 1. In terms of ROE and ROA, it has been generally been quite stable.

Qualitative Analysis:

Looking at the company’s revenue, 91% of it comes from recurring income from existing customers. Hence, it is crucial to analysis if the company is able to retain customer loyalty and if they are able to defend this economic moat they have well. Also, in the home security industry, the other top 2 players are Protect America and FrontPoint Security.

(I) Economic Moat:

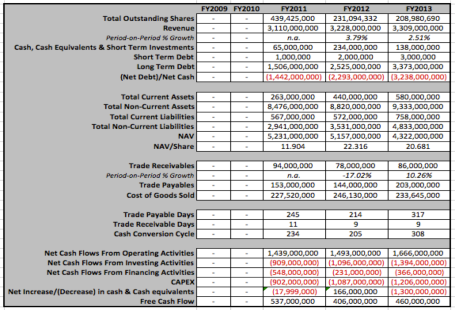

Looking at a survey done by Bain Capital:

We can seen that ADT Corporation is definitely a brand many US residents are able to relate to and are the first to consider when it comes to home security. Furthermore, what is important to take note of is that there are actually 50% of their customers who did not bother considering any other brands when choosing home security.

(II) Business Analysis:

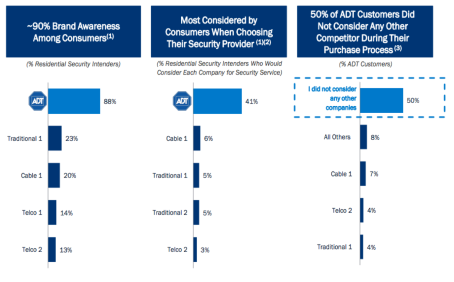

(II.1) Essentially, when choosing a home security company, what qualities are we actually looking out for?

1) Experience matters – One definitely wants a security company who has the experience in keeping their families safe. It need not be a long track record but rather one that has proved itself efficient and effective over a number of years and comes highly recommended from respected sources.

2) Wireless matters – Wireless is the way going forward. Wireless systems cannot be disarmed with a snip nor are they easy to tamper with. A weak cellular signal, not even a phone line, is needed to operate a wireless security system.

3) Power backup – In an event of a power shortage, we definitely want the alarm to still be live.

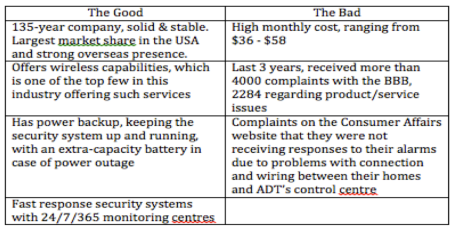

(II.2) Now, we will compare the advantages and disadvantages of choosing ADT Corporation as our home security system.

(II.3) Evaluation:

1) Cost – Comparing ADT to other reputable brands , the monthly cost is approximately the same. Picking the other top 2, FrontPoint Security cost $35 – $50. While Protect America cost from $20 – $43.

- NB: Protect America charges for the number of door and window sensors, meaning that for lower cost packages there will be doors/windows without sensors which defeats the point of a home security system.

2) Complaints – Compared to FrontPoint Security, ADT definitely has failed in this aspect. FrontPoint Security has very few negative complaints. In fact, they have always responded directly to either apologize, or to explain the situation. Only 28 complaints registered by the BBB. Likewise with Protect America, they have only 395 complaints registered with the BBB. All complaints to date have been closed and its important to note that with 130,000 monthly customers that’s 0.003% complaints of their customer base.

3) Wireless – ADT has been pushing their wireless services, trying to mitigate such problems from occurring.

(III) Valuation:

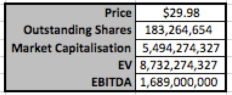

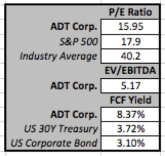

Looking at ADT Corporation in terms of P/E, it is definitely not cheap especially based on empirical research. However, comparing it to the S&P 500 and Industry Average, it is still relatively cheap. In terms of EV/EBITDA, at 5.17 it is definitely cheap in terms of empirical research. While in terms of FCF yield of approximately 8% compared to the US 30Y Treasury or Corporate Bond yielding at approximately 4%, it suggests that there is a 100% upside in price. However, giving a 30% discount for any miscalculations and errors, there is still a 70% upside in price which is a relatively comfortable margin of safety in my opinion.

(IIII) Conclusion:

Looking at ADT Corporation in all aspects, while in terms of fundamentals, it may still not be very strong, however, given that it is a relatively young country, I would not use current results to project what the company would be like 5 or 10 years down the road. Qualitatively, ADT is a household name, with strong consumer penetration within the United States. While it has its fair share of negative complaints, so do other companies. While not trying to defend their mistakes of not resolving issues quickly, with 6.4 million customers, one has to understand that they are unable to provide the kind of personalised feedback like FrontPoint and Protect America. While ADT may be slightly costly, it pays to know that our family is safe. Lastly, in terms of valuations, I would say that with all indicators showing that the company is undervalued, and an upside of 70% after discounting for mistakes and errors, I would say that ADT Corporation is an undervalued company.

Disclosure: The author is long ADT Corporation (USD 28.50). It will not be reflected in my SG holdings, but it is held within my family portfolio.